Multi-Index range

The Multi-Index range is LGIM’s flagship multi-asset fund range for our adviser clients.

We offer five, risk-targeted funds for a range of specific investor profiles. The asset allocation of the funds is managed dynamically investing across equities, bonds, alternatives and cash. For those seeking income, we offer three funds again catering to different risk profiles. These employ a similar asset allocation, but tilted towards securities paying attractive dividends or coupons.

Five years of Multi-Index: the story so far

Five years on from the launch of our successful Multi-Index range, we ask our team what makes the funds tick. Click play to hear more about how suitability, cost-effectiveness, diversification and dynamic asset allocation are the driving forces behind the range.

Growth focused funds

Income focused funds

Dynamic decision-making

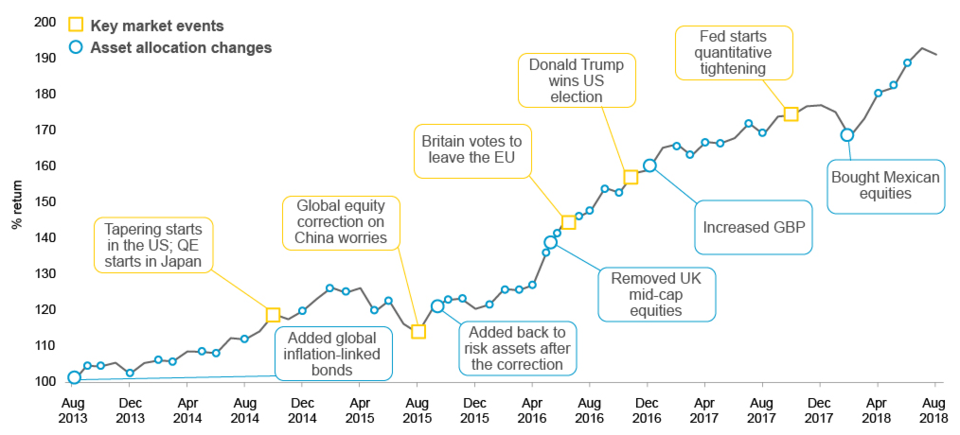

The timeline below displays some of the team’s key asset allocation decisions, plotted against the MSCI World, illustrating our dynamic decision-making process around significant market events.

Source: Bloomberg L.P. to 31 August 2018

Past performance is no guide to future performance.

Meet the team

The fund managers have responsibility for managing the multi-index fund range. They are part of the Multi-Asset Funds (MAF) team in LGIM. This team focuses on designing and managing multi-asset funds that are tailored to match the specific objectives of various client types. The team sits within a wider Asset Allocation team which combines both depth of experience with a broad range of expertise from different fields, including fund management, investment consulting and risk management roles.

AndrzejPioch

FrancisChua